UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to | |

AKORN, INC.

(Name of Registrant as Specified In Its Charter)

(NamePayment of Person(s) Filing Proxy Statement, if other thanFee (Check the Registrant)

appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

1925 West Field Court, Suite 300 Lake Forest, Illinois 60045 |

Dear Shareholder:

You are cordially invited to attend a special meeting of the shareholders of Akorn, Inc. to be held at 10:00 a.m., local time (Central Standard Time) on December 16, 2016,

Dear Shareholder: You are cordially invited to attend the 2017 annual meeting of shareholders of Akorn, Inc. to be held at 10:00 a.m., local time (Central Time) on April 27, 2017, at the Company’s corporate headquarters at 1925 West Field Court, Suite 300, Lake Forest, Illinois 60045 for the following purposes, as more fully described in the proxy statement:

| |||||||||||||||||||||||||||||||||||

You may attend the meeting in person or by proxy. Only shareholders or their legal proxy holders will be allowed to attend the 2017 annual meeting. To be admitted to the 2017 annual meeting, you must present a form of government-issued photo identification and valid proof of ownership of the Company’s common stock as of March 13, 2017 or a valid legal proxy. Your vote is important. We strongly urge you to cast your vote as soon as possible, even if you currently plan to attend the meeting in person. You may vote your shares by Internet or telephone, or by following the instructions on the proxy card or the voting instruction form you receive with your paper copy of the print materials. We appreciate your investment in the Company. By Order of the Board of Directors /S/ Raj Rai Raj Rai Chief Executive Officer March 20, 2017 | |||||||||||||||||||||||||||||||||||

Notice of the Company’s common stock as of October 28, 2016 or a valid legal proxy.2017 Annual Meeting

Your vote is important. We strongly urge you to cast your vote as soon as possible, even if you currently plan to attend the meeting in person. You may vote your shares by Internet or telephone, or by following the instructions on the proxy card or the voting instruction form you receive with your paper copy of the print materials.

We appreciate your investment in the Company.

By Order of the Board of Directors

Raj Rai

Chief Executive Officer

November 14, 2016

A specialThe 2017 annual meeting of shareholders of Akorn, Inc., a Louisiana corporation, will be held at the time and place and for the purposes indicated below.

December 16, 2016

April 27, 2017

10:00 a.m., Local Time

1925 West Field Court, Suite 300, Lake Forest, Illinois 60045

| Items of |

| • | To elect eight directors from the nominees named in the proxy statement to serve until the 2018 annual meeting or until their successors are elected and qualified (Proposal 1); | |

| • | To ratify the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2017 (Proposal 2); | |||

| • | To approve the | |||

| • | To approve, through anon-binding advisory vote, the frequency of futurenon-binding advisory votes regarding the Company’s executive compensation programs (Proposal 4); | |||

| • | To approve, through anon-binding advisory vote, the Company’s executive compensation program (Proposal 5); and | |||

| • |

| |||

of the | The Board of Directors unanimously recommends that you vote | |||

| “FOR” Proposals 2, 3 and 5. | ||||

| Shareholders of record as of the close of business | ||||

| Your vote is very important.To ensure your representation at the meeting, please vote your shares as soon as possible, by Internet or telephone, or proxy card or voter instruction form. | ||||

By Order of the Board of Directors

/S/ Raj Rai

Raj Rai

Chief Executive Officer

Important Notice Regarding the Availability of Proxy Materials for theSpecial Annual Meeting of Shareholders to Be Held on December 16, 2016. April 27, 2017.

The proxy statement, the form of proxy card, and the annual report to shareholders for the

fiscal year ending December 31, 20152016 are availableat http://www.proxyvote.com.

TABLE OF CONTENTS |

PROXY STATEMENT |

AKORN, INC.

1925 West Field Court, Suite 300

Lake Forest, Illinois 60045

March 20, 2017

November 14, 2016

For the SpecialAnnual Meeting of Shareholders to be held December 16, 2016April 27, 2017

The Board of Directors (the “Board”) of Akorn, Inc. (the “Company”) is furnishing you this proxy statement to solicit proxies on its behalf to be voted at the 2016 special2017 annual meeting of shareholders of Akorn, Inc. The special meeting will be held at the Company’s headquarters, at 1925 West Field Court, Suite 300, Lake Forest, Illinois 60045, on December 16, 2016,April 27, 2017, at 10:00 a.m., local time.

This proxy statement contains information on matters to be voted upon at the 2016 specialannual meeting or any adjournments of that meeting. As of the date of this proxy statement, management is unaware of any other matter for action by shareholders at the meeting other than those described in the accompanying Notice of the 2016 Special2017 Annual Meeting. All properly executed written proxies and all properly completed proxies submitted by telephone or Internet that are delivered pursuant to this solicitation will be voted at the meeting in accordance with the directions given in the proxy, unless the proxy is revoked prior to completion of voting at the meeting.

The proxy materials for our 2016 special2017 annual meeting include: (1) theThe Notice of 2016 Special2017 Annual Meeting of Shareholders; (2) thisThis Proxy Statement for the SpecialAnnual Meeting including the formsform of the Akorn, Inc. 2016 Employee Stock Purchase Plan and Amended and Restated Akorn Inc., 2014 Stock Option2017 Omnibus Incentive Compensation Plan; (3) Akorn’s Annual Report for the year ended December 31, 2015;2016; and (4) the proxy card or voting instruction form for the 2016 special meeting that you received with your paper copy of the proxy materials.

form.

Please see the section “Questions and Answers” at the back of this proxy statement for more information regarding the proxy materials, the special2017 annual meeting, voting, submitting proposals for next year’s annual meeting and other related matters.

This proxy statement is dated November 14, 2016March 20, 2017 and we are first furnishingmailing the proxy materials to shareholders on or about November 14, 2016.March 20, 2017.

Important Notice Regarding the Availability of Proxy Materials for the Special2017 Annual Meeting of

Shareholders to Be Held on December 16, 2016:

April 27, 2017:

The Notice of 2016 SpecialAnnual Meeting, proxy statement, form of proxy card, and 20152016 annual report to

shareholders are available at http://www.proxyvote.com.

I. CORPORATE GOVERNANCE AND RELATED MATTERS |

I. Corporate Governance and Related Matters

Board of Directors

The age, principal occupation and employment, position with us, directorships in other public corporations, qualifications for directorship and year first elected or appointed as one of our directors, of each of our nominees and current directors, as applicable, are included in this proxy statement under the heading “PROPOSAL 1. ELECTION OF DIRECTORS.”

Independence of the Board of Directors

Our common stock is traded on The NASDAQ Global Select Market (“NASDAQ”). The Board has determined that a majority of the members of, and nominees to, the Board qualify as “independent,” as defined by the listing standards of NASDAQ. Consistent with these considerations, after review of all relevant transactions and relationships between each director and nominee, or any of his family members, and the Company, its senior management and its independent auditors, the Board has further determined that all of our directors and nominees to serve as directors are “independent” under the listing standards of NASDAQ, except for Dr. Kapoor and Mr. Tambi. In making this determination, the Board considered that there were no new transactions or relationships between its current directors and the Company, its senior management and its independent auditors since last making this determination.

Leadership Roles

Our bylaws do not require that the positions of Chairman of the Board of Directors and Chief Executive Officer (“CEO”) be separate. Our bylaws allow us the flexibility to decide how the two positions should be filled based on the circumstances existing at any given time. Further, the Board does not have a formal policy relating to the separation of the offices of Chairman of the Board and CEO. Our offices of Chairman of the Board and CEO have been separate since 2002, when our Chairman, John Kapoor last served as both Chairman of the

Board and CEO. Currently, with the separation of the positions, the Chairman of the Board oversees strategic planning for the Company, and the CEO oversees theday-to-day planning, execution and operational matters. The Board believes that the separation of the two roles provides a balance of these important responsibilities and best suits the skills of Dr. Kapoor and Mr. Rai. However, the Board believes that retaining the flexibility to unify the two roles is beneficial to the Company, and as such, the Board intends to continue to exercise its discretion in combining or separating these positions depending on the particular circumstances and needs of the Company at any time.

Risk Management

We accept the premise that with innovation and progress we must also confront various risks. We also recognize that risk can be predicted, evaluated, avoided and/or managed. Further, the Board acknowledges that inappropriate risk avoidance and management could damage Company assets as well as shareholder value. Given these principles, senior management is responsible for assessing and managing the Company’s various exposures to risk on aday-to-day basis, including the creation of appropriate risk management and compliance programs and policies. We have developed a consistent, systemic and integrated approach to risk management to help determine how best to identify, manage and mitigate significant risks throughout the Company. The Board is responsible for overseeing management in the execution of its responsibilities and for assessing the Company’s approach to risk management. The Board’s role in risk oversight of the Company is consistent with the Company’s leadership structure, with the CEO and other members of senior management having responsibility for assessing and managing the Company’s risk exposure, and the Board providing guidance in these areas.

| AKORN, INC. - |

I. CORPORATE GOVERNANCE AND RELATED MATTERS |

Executive Sessions of Independent Directors and Shareholder Communications

Our independent directors meet periodically in executive sessions when only independent directors are present. Persons interested in communicating with the independent directors may address correspondence to a particular director or to the independent directors generally, in care of Corporate Secretary, Akorn, Inc., 1925 West Field Court, Suite 300, Lake Forest, Illinois 60045.

Board Meetings and Annual Meeting Attendance

Our Board held fourteen (14) meetings in 2016. Each of our directors attended 75% or more of the aggregate number of meetings of our Board held during the period in which he or she was a director and the number of meetings held by all Board committees on which he or she served during 2016 except Mr. Tambi who attended just under that percentage. Directors are strongly

encouraged to attend the annual meeting of shareholders unless extenuating circumstances prevent them from attending, although we do not have a formal, written policy requiring such attendance. All members of the Board attended the 2016 annual meeting except Mr. Weinstein who was out of the country.

Committees of the Board

The Board has three standing committees: an audit committee (the “Audit Committee”), a compensation committee (the “Compensation Committee”), and a nominating and corporate governance committee (the “Nominating and Corporate Governance Committee”). From time to time, the Board may create special committees. The below chart shows the current members and chairpersons of our three standing committees, though the Board has and may create other special committees from time to time, which committees may not necessarily be listed below or described herein.

| Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | ||||

John N. Kapoor, Ph.D. | — | — | — | |||

Kenneth S. Abramowitz | Member | — | — | |||

Adrienne L. Graves | — | Chair | Member | |||

Ronald M. Johnson | Member | Member | — | |||

Steven J. Meyer | Chair | — | Member | |||

Terry Allison Rappuhn | Member | — | Member | |||

Brian Tambi | — | — | — | |||

Alan Weinstein | — | Member | Chair |

The composition of Board committees is reviewed and determined each year at the initial meeting of the Board after the annual meeting of shareholders.

Audit Committee

The Audit Committee of the Board oversees our corporate accounting and financial reporting process and audits of our financial statements. For this purpose, the Audit Committee performs several functions. The Audit Committee evaluates the performance and assesses the qualifications of the Company’s independent

registered public accounting firm (the “independent auditors”); determines and approves the engagement of the independent auditors; determines whether to retain or terminate the existing independent auditors or to appoint and engage new independent auditors; reviews and approves the retention of the independent auditors to perform any proposed permissiblenon-audit services; monitors the rotation of partners of the independent auditors on our audit engagement team as required by law; confers with management and the independent auditors regarding the effectiveness

| AKORN, INC. - 2017 Proxy Statement | 3 |

I. CORPORATE GOVERNANCE AND RELATED MATTERS |

of internal controls over financial reporting; establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; reviews and approves related person transactions; reviews the financial statements to be included in our Annual Report on Form10-K and quarterly reports on Form10-Q; and discusses with management and the independent auditors the results of the annual audit and the results of the reviews of our quarterly financial statements. The Audit Committee met sixteen (16) times during the 2016 fiscal year. A current copy of the Audit Committee Charter, which has been adopted and approved by the Board, is available on our website at http://www.akorn.com (the contents of such website are not incorporated into this proxy statement).

The Board has reviewed NASDAQ’s definition of independence for Audit Committee members and has determined that all members of our Audit Committee are “independent” under the listing standards of NASDAQ. Further, the Board determined that each of the members of the Audit Committee is “independent” in accordance with Rule10A-3 of the Exchange Act. The Board has determined that Mr. Abramowitz, Mr. Meyer and Ms. Rappuhn each qualify as an “audit committee financial expert,” as defined in applicable SEC rules. The Board has made a qualitative assessment of Mr. Abramowitz’s level of knowledge and experience based on a number of factors, including his formal education and his experience as a Managing Director for the Carlyle Group, as an analyst for more than 20 years at Sanford C. Bernstein & Company as well as his experience as Managing General Partner of a venture capital firm. The Board made a qualitative assessment of Mr. Meyer’s level of knowledge and experience based on a number of factors, including his formal education, and his experience as the Chief Financial Officer of JVM Realty, a private firm specializing in the acquisition,re-positioning and management of multi-family housing for qualified investors, as well as his experience as Corporate Treasurer and International Controller and Vice President of

Global Operations at Baxter International, Inc. The Board also made a qualitative assessment of Ms. Rappuhn’s level of knowledge and experience based on a number of factors, including her formal education and her experience as a Chief Financial Officer of Quorum Health Group, Inc., a previously public company that owned and operated acute care hospitals, as well as her experience as VP, Controller and Assistant Treasurer and VP, Internal Audit at Quorum, her 15 years of experience with Ernst & Young, LLP and her prior service as audit committee chairperson for other public companies. Shareholders should understand that this designation is a disclosure requirement of the SEC related to Mr. Meyer’s and Ms. Rappuhn’s experience and understanding with respect to certain accounting and auditing matters. The designation does not impose upon Mr. Meyer or Ms. Rappuhn any duties, obligations or liabilities that are greater than are generally imposed on them as members of the Audit Committee and the Board, and their designation as an audit committee financial expert pursuant to this SEC requirement does not affect the duties, obligations or liabilities of any other member of our Audit Committee or the Board.

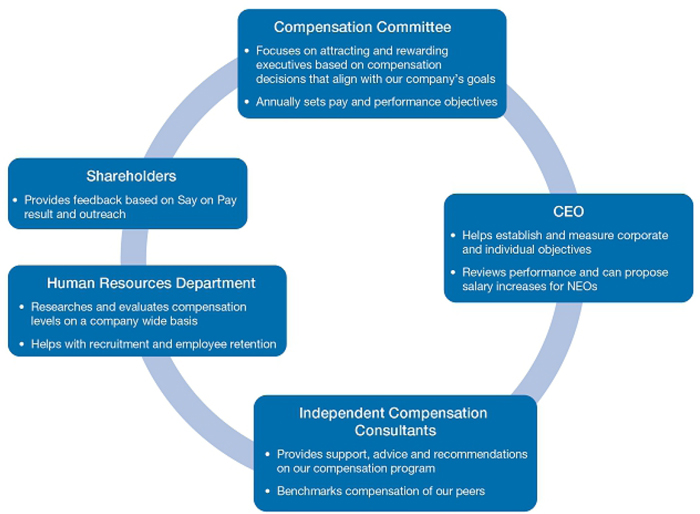

Compensation Committee

The Compensation Committee, which met twelve (12) times during 2016, reviews and approves the overall compensation strategy and policies for the Company. The Compensation Committee reviews and approves corporate performance goals and objectives relevant to the compensation of our executive officers and other senior management; reviews and approves the compensation and other terms of employment of our executive officers; and administers equity awards and stock purchase plans. Each member of the Compensation Committee has been determined by the Board to be “independent” under the listing standards of NASDAQ. A current copy of the Compensation Committee Charter, which has been adopted and approved by the Board, is available on our website at http://www.akorn.com (the contents of such website are not incorporated into this proxy statement). The Compensation Committee has authority to obtain advice and seek assistance from internal and external accounting and other advisors and to determine the extent of funding

| AKORN, INC. - 2017 Proxy Statement | 4 |

I. CORPORATE GOVERNANCE AND RELATED MATTERS |

necessary for the payment of any consultant retained to advise it.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for developing and implementing policies and processes regarding corporate governance matters, assessing Board membership needs and making recommendations regarding potential director candidates to the Board. A current copy of the Nominating and Corporate Governance Committee Charter, which has been adopted and approved by the Board, is available on our website at http://www.akorn.com (the contents of such website are not incorporated into this proxy statement). Each member of the Nominating and Corporate Governance Committee has been determined by the Board to be “independent” under the listing standards of NASDAQ. The Nominating and Corporate Governance Committee met four (4) times during 2016.

The Board believes that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Board also considers such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of our shareholders. However, the Board retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of shareholders. In conducting this assessment, the Board considers skills, diversity, age, and such other factors as it deems appropriate given the current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability. The Board strives to achieve diversity in the broadest sense, including persons diverse in geography, age, gender, ethnicity, knowledge and experiences. Although the Board does not have a

stand-alone diversity policy, the Board’s overall diversity is a significant consideration in the director selection and nomination process. The Board and Nominating and Corporate Governance Committee assess the effectiveness of board diversity efforts in connection with the annual nomination process as well as in new director searches. Currently, almost half of the Directors are women or minorities. In the case of incumbent directors whose terms of office are set to expire, the Board and the Nominating and Corporate Governance Committee review such directors’ overall service to the Company during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such director’s independence. In the case of new director candidates, the Board also determines whether the nominee must be independent, which determination is based upon applicable SEC and NASDAQ rules.

Board members should possess such attributes and experience as are necessary to provide a broad range of personal characteristics, including diversity, management skills, and pharmaceutical industry, financial, technological, business and international experience. Directors selected should be able to commit the requisite time for preparation and attendance at regularly scheduled Board and committee meetings, as well as be able to participate in other matters necessary for good corporate governance.

In order to identify a potential Board candidate, the Board uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Board conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Board meets to discuss and consider such candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote. To date, the Board has not paid a fee to any third party to assist in the process of identifying or evaluating director candidates, nor has the Board rejected a director nominee from a shareholder or shareholders. Upon the election of nominees at our annual meeting of shareholders on April 27, 2017, the Board will

| AKORN, INC. - 2017 Proxy Statement | 5 |

I. CORPORATE GOVERNANCE AND RELATED MATTERS |

have one vacancy, which is reserved for a nominee to be named by our Chairman, Dr. John Kapoor, in accordance with terms of a Modification, Warrant and Investor Rights Agreement entered into on April 13, 2009 between the Company and EJ Funds, LP, a company controlled by our Chairman.

Although there is no formal procedure for shareholders to recommend nominees for the Board, the Nominating and Corporate Governance Committee will consider such recommendations for the 2018 annual meeting if received by November 24, 2017, and if subsequent to the 2018 annual meeting, recommendations will be considered if received 120 days in advance of the date on which the Company released its definitive proxy statement in the previous year, addressed to the Nominating and Corporate Governance Committee, in care of Corporate Secretary, Akorn, Inc., 1925 West Field Court, Suite 300, Lake Forest, Illinois 60045. Such recommendations should be addressed to the Nominating and Corporate Governance Committee at our address and provide all information relating to such person that the shareholder desires to nominate that is required to be disclosed in solicitation of proxies pursuant to Regulation 14A under the Exchange Act. The Board does not believe that a formal procedure for shareholders to recommend nominees for the Board is necessary because every effort has been made to ensure that nominees recommended by shareholders are

given appropriate consideration by the Nominating and Corporate Governance Committee. See “What are the deadlines for submitting shareholder proposals for the 2018 annual meeting?” in part V. Questions and Answers of this proxy statement.

Shareholder Outreach Program

We have a robust shareholder outreach program, facilitated by our Investor Relations department and supported by senior leaders from our organization, including our CEO and CFO. Through our outreach program, we speak with our shareholders on a regular basis throughout the year. Our Investor Relations team and senior managers also speak with analysts and others about general matters related to Akorn.

Communications with the Board

Shareholders and other interested parties who wish to communicate with the Board of Directors, or a particular director or group of directors, may do so by sending a letter to Akorn, Inc., Attention: Corporate Secretary, 1925 W. Field Court, Suite 300, Lake Forest, Illinois 60045. The mailing envelope should contain a clear notation indicating that the enclosed letter is a “Board Communication” or “Director Communication”, and the letter should indicate whether the intended recipients are the entire Board, a specific group or committee of the Board, or an individual director. All such communications received by the Company will be promptly copied and distributed to the appropriate director or directors.

| AKORN, INC. - 2017 Proxy Statement | 6 |

I. CORPORATE GOVERNANCE AND RELATED MATTERS |

The Audit Committee oversees Akorn’s financial reporting process on behalf of the Board. As part of this oversight function, the Audit Committee oversees Akorn’s compliance with legal and regulatory compliance and monitors Akorn’s compliance with Section 404 of the Sarbanes-Oxley Act of 2002, which includes receiving regular reports and representations by management and the Chief Audit Executive of Akorn and its independent auditors, each of whom is given full and unlimited access to the Audit Committee to discuss any matters which they believe should be brought to our attention.

In carrying out its responsibilities, the Audit Committee acts in an oversight capacity. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls.

In this context, the Audit Committee has met and discussed the audited financial statements with management. Management represented to the Audit Committee that Akorn’s consolidated financial statements were prepared in accordance with generally accepted accounting principles.

The independent auditors reviewed with the Audit Committee the planning and scope of the audit of Akorn’s consolidated financial statements and management’s assessment of the effectiveness of internal control over financial reporting. The independent auditors regularly updated the Audit Committee regarding the audit status, as well as observations from their review of Akorn’s quarterly consolidated financial statements. Members of the Audit Committee met privately with the independent auditors throughout the year regarding internal control over financial reporting matters and the status of remediation of material weaknesses.

The Audit Committee discussed with the independent auditors matters required to be discussed by Public Company Oversight Board Auditing Standard No.1301. In addition, the Audit Committee has discussed with the independent auditors the auditors’ independence from Akorn and its management, including the matters in the written disclosures and the applicable letter received by the Audit Committee from the independent auditors as required by PCAOB Ethics and Independence Rule 3526,Communication with Audit Committees Concerning Independence. The Audit Committee has also reviewed the certifications of the executive officers of Akorn attached as exhibits to Akorn’s Annual Report onForm 10-K for the 2016 fiscal year as well as all reports issued by Akorn’s independent auditor related to its audit of Akorn’s financial statements for the 2016 fiscal year and the effectiveness of Akorn’s internal control over financial reporting.

The Audit Committee has also considered whether the independent auditors’ provision ofnon-audit services to Akorn is compatible with the auditors’ independence.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board, and the Board approved, the inclusion of the audited comprehensive consolidated financial statements in Akorn’s Annual Report on Form10-K for the year ended December 31, 2016, for filing with the SEC.

This report is submitted by the Audit Committee, consisting of:

Steven J. Meyer, Chair

Kenneth S. Abramowitz

Ronald M. Johnson

Terry Allison Rappuhn

| AKORN, INC. - 2017 Proxy Statement | 7 |

I. CORPORATE GOVERNANCE AND RELATED MATTERS |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Review and Approval of Transactions with Related Persons

Under the Company’s Code of Ethics, all employees and directors must report any activity that would cause or appear to cause a conflict of interest on his or her part, including any potential related party transactions. Akorn’s Board recognizes that certain transactions present a heightened risk of conflicts of interest or the perception of a conflict of interest. As a result, in 2016, the Company adopted a written Policy on Related-Party Transactions (“Related-Party Transactions Policy”) to help ensure that all related-party transactions will be subject to review, approval or ratification in accordance with certain procedures.

The Related-Party Transactions Policy applies to any transaction where the Company is a participant and a related person has or will have a direct or indirect material interest. Under the policy, a “related person” is defined as our directors, director nominees, executive officers and any other employees, beneficial owners of more than 5% of the outstanding shares of our common stock and the respective immediate family members of all such persons. Under the policy, a “related-party transaction” is defined as any transaction or relationship in which the Company is or will be a participant and any related party has or will have a direct or indirect material interest.

Pursuant to our Related-Party Transactions Policy, prior to entering into a related-party transaction, a related party is required to notify the General Counsel of any material interest that such person (or his or her immediate family member) has or may have in the proposed transaction. The notice should include a description of the material terms of the transaction, including the related person and his or her relationship to the Company, the related person’s interest and role in the proposed transaction, and the aggregate cost to or benefit to be derived by the related person and the Company if known. From time to time, the Company also takes measures to identify potential related-party transactions that might not have been self-reported. For example, at least once a year, the internal audit department

requires all employees at the associate director level and above to answer a survey regarding their knowledge of any related-party transactions involving themselves, their direct reports or any other employees of the Company. The internal audit department also cross-checks names of related parties of the Company’s officers and directors against the names in the Company’s accounts payable and accounts receivable databases to identify any potential related-party transactions that may have occurred in the prior fiscal year. Any transactions that are identified during such processes (self-reporting, survey, cross-checking names in databases) are presented to the General Counsel for review.

Under our policy, the General Counsel notifies the Audit Committee of any pending or proposed related-party transaction (or existing transaction that was not previously reported). Pursuant to the policy, our General Counsel is responsible for the review and approval of related-party transactions in which the aggregate amount involved is expected to be $50,000 or less in any fiscal year. Pursuant to the policy, the General Counsel will consult with one or more officers when making such determination. The Audit Committee is responsible for the review and approval of related-party transactions in which the aggregate amount involved may be expected to exceed $50,000 in any fiscal year. No related party is allowed to participate in any deliberation or approval of a related-party transaction for which he or she or any member of his or her immediate family is a related party.

Pursuant to the policy, in the event the Company, a director, any member of senior management or other employee becomes aware of a related-party transaction which has not been approved under the policy, he or she is required to report the transaction to the General Counsel, who will refer the matter to the Audit Committee as appropriate.

In determining whether to approve or ratify a transaction, the Audit Committee or General Counsel, as the case may be, considers all of the relevant facts and circumstances they deem appropriate, including, but not limited to, the terms and circumstances of the transaction, the

| AKORN, INC. - 2017 Proxy Statement | 8 |

I. CORPORATE GOVERNANCE AND RELATED MATTERS |

extent of the related party’s interest in the transaction, the nature of the Company’s participation in the transaction, the availability to the Company of alternative means or transactions to obtain like benefits, the results of an appraisal, whether the transaction was entered into on terms no less favorable to the Company than the terms generally available to an unaffiliated third-party under the same or similar circumstances, and whether the transaction is fair to the Company and in the interest of the Company and its stockholders. In addition, pursuant to the Audit Committee Charter, the Audit Committee discusses with the independent auditor the Company’s identification, accounting for and disclosures of related-party transactions and any concerns members of the Audit Committee have regarding any related-party transactions.

The Related-Party Transaction Policy classifies certain transactions aspre-approved, including: (a) employment of executive officers and director compensation, if the compensation is required to be reported under Item 402 of RegulationS-K and the officer is not an immediate family member of another officer or director; (b) transactions with another company or charitable contributions if the related person’s only relationship is as an employee (other than executive officer), director or beneficial owner of less than 10% of that company’s outstanding equity if the aggregate amount involved does not exceed the greater of (or in the case of a charity, the lesser of) $200,000 or 2% of that company’s total annual revenues or charitable organization’s total annual receipts; (c) transactions where the related person’s interest arises solely from the ownership of the Company’s stock and all stockholders benefit on a pro rata basis; (d) regulated transactions involving services as a common or contract carrier or public utility at rates fixed in conformity with law or governmental authority; and (e) transactions where the rates or charges involved are determined by competitive bids.

Certain Transactions and Relationships

In accordance with Item 404(a) ofRegulation S-K, below are descriptions of

related-party transactions that existed or that we have entered into since the beginning of 2016 and the amount involved was more than $120,000 and certain other relationships.

John N. Kapoor, Ph.D., the Chairman of our Board of Directors, is a principal shareholder. As of December 31, 2016, Dr. Kapoor beneficially controls approximately 25% of our common stock. In addition, through the Kapoor Trust and EJ Financial, Dr. Kapoor is entitled to nominate up to three persons to serve on our Board. Dr. Kapoor and Mr. Brian Tambi were nominated for these purposes. The other seat for nomination has remained vacant. See “Director Compensation” for more information.

The Company obtained legal services totaling $1.3 million for the year ended December 31, 2016 from Polsinelli PC, a firm for which the spouse of the Company’s Executive Vice President, General Counsel and Secretary is a shareholder.

The Company obtained legal services totaling $0.1 million for the year ended December 31, 2016 from Segal McCambridge Singer and Mahoney, a firm for which thebrother-in-law of the Company’s Executive Vice President, General Counsel and Secretary is a shareholder.

The Company has entered into employment agreements and offer letters with its Named Executive Officers. The terms of such agreements are described under“Compensation Discussion and Analysis” and“Potential Payments Upon Termination.”

Our executive officers and directors have equity ownership in our Company. See“Outstanding Equity Awards at 2016 Year-End Table” and “Security Ownership of Certain Beneficial Owners and Management.”

Board Independence

Our Board has determined that all of our directors, other than Dr. Kapoor and Mr. Tambi, are “independent” as defined in the federal securities laws and applicable NASDAQ rules for service on our Board. In recommending to the

| AKORN, INC. - 2017 Proxy Statement | 9 |

I. CORPORATE GOVERNANCE AND RELATED MATTERS |

Board that each of the independent directors be classified as independent, the Nominating and Governance Committee also considered whether there were any facts or circumstances that might

impair the independence of each of those directors. In making this determination, the Board considered all transactions and relationships discussed above.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors and executive officers and persons who beneficially own more than 10% of our common stock to file reports of security ownership and changes in such ownership with the SEC. Based solely on our review of the reports that have been filed by or on behalf of such persons in this regard and written representations from them, we

believe that all such persons have timely filed all reports required by Section 16(a) of the Exchange Act during 2016, except for one transaction by each of Raj Rai, Joseph Bonaccorsi and Bruce Kutinsky involving the forfeiture of shares upon the vesting of restricted stock units.

Our Board has adopted a Code of Ethics that is applicable to all employees, including our principal executive officer, principal financial officer, principal accounting officer, controller and persons performing similar functions, as well as members of the Board. We intend to satisfy any disclosure requirements under Item 5.05 of Form8-K regarding an amendment to, or waiver from, any provision of the Code of Ethics with respect to our principal executive officer, principal financial officer, principal accounting officer, controller and persons performing similar functions by disclosing the nature of such amendment or waiver on our website or in a report on Form8-K. A copy of the Code of Ethics can be obtained at our website.

Our website address is http://www.akorn.com (the contents of such website are not incorporated into this proxy statement).

Our Audit Committee has adopted a whistleblower policy in compliance with Section 806 of the Sarbanes-Oxley Act and Section 21F of the Exchange Act. The whistleblower policy allows employees to confidentially submit a good faith complaint regarding accounting or audit matters to the Audit Committee and management without fear of dismissal or retaliation. This policy, as well as a copy of our Code of Ethics, is distributed to all our employees for signature and signed copies are on file in our Human Resources Department.

| AKORN, INC. - 2017 Proxy Statement | 10 |

II. PROPOSALS |

PROPOSAL 1 ELECTION OF DIRECTORS

The Company’s Board of Directors (“Board”) has nominated eight candidates for election at the 2017 annual meeting. All of the nominees listed below are currently directors. The table below sets forth the age, position with the Company, and year first elected or appointed as a director of the Company, of each of the eight nominees. The narrative descriptions below set forth the

principal occupation, employment, position with the Company (if any), and directorships in other public corporations, of each of the eight nominees. Unless otherwise indicated, each nominee has been engaged in the principal occupation or occupations described below for more than the past five years.

| Name | Age | Director Since | Present Position with Akorn | |||||||

John N. Kapoor, Ph.D. | 73 | 1990 | Chairman of the Board | |||||||

Kenneth S. Abramowitz | 66 | 2010 | Director | |||||||

Adrienne L. Graves | 63 | 2012 | Director | |||||||

Ronald M. Johnson | 71 | 2003 | Director | |||||||

Steven J. Meyer | 60 | 2009 | Director | |||||||

Terry Allison Rappuhn | 60 | 2015 | Director | |||||||

Brian Tambi | 71 | 2009 | Director | |||||||

Alan Weinstein | 74 | 2009 | Director | |||||||

JOHN KAPOOR, PH.D | ||

Director Since: 1990 Age: 73 |

Dr. Kapoor has served as the Chairman of our Board since October 1990. Dr. Kapoor served as our interim Chief Executive Officer from March 2001 to May 2002 and as our Chief Executive Officer from May 2002 to December 2002. Dr. Kapoor is the President of EJ Financial Enterprises, Inc., a healthcare consulting and investment company. Dr. Kapoor is a director (and former chairman, President and Chief Executive Officer) of Insys Therapeutics, Inc. (NASDAQ: INSY), a publicly held drug development company focused on pain and oncology, into which NeoPharm, Inc. (previously a publicly held biopharmaceutical company) merged in October 2010. Prior to NeoPharm’s merger, Dr. Kapoor was the chairman of its board of directors. Previously, Dr. Kapoor was the chairman of the board of directors of Option Care, Inc., a leading provider of home infusion pharmacy and specialty pharmacy services, which was acquired by Walgreen Co. in August 2007. Dr. Kapoor received his Ph.D. in Medicinal Chemistry from the State University of New York at Buffalo and a B.S. in Pharmacy from Bombay University in India. Under agreements between Akorn and the John N. Kapoor Trust dated 9/20/89 (the “Kapoor Trust”), the beneficiary and sole trustee of which is Dr. John N. Kapoor, the Kapoor Trust is entitled to designate one individual to be nominated and recommended by our Board for election as a director. Dr. Kapoor was designated by the Kapoor Trust for this purpose.

Among other qualifications, Dr. Kapoor brings to Akorn’s Board a breadth and depth of pharmaceutical industry and operational knowledge, entrepreneurial vision, business leadership and valuable perspective that he has gained as a founder of generic pharmaceutical companies as well as from his current and prior service as chief executive officer, chairman and director of a number of publicly and privately held healthcare, pharmaceutical and health services companies.

| AKORN, INC. - 2017 Proxy Statement | 11 |

II. PROPOSALS |

| ||

Director Since: 2010 Age: 66 | Committees: • Audit |

Mr. Abramowitz was elected to the Board in May 2010. Mr. Abramowitz is Managing General Partner of NGN Capital, a venture capital firm that heco-founded in 2003 which focuses on investments in the healthcare and biotechnology sectors. Mr. Abramowitz joined NGN Capital from The Carlyle Group in New York where he was Managing Director from 2001 to 2003 and focused on U.S. buyout opportunities in the healthcare industry. Prior to that, Mr. Abramowitz worked as an analyst at Sanford C. Bernstein & Company, where he covered the medical supply, hospital management and health maintenance organization (HMO) industries for 23 years. Mr. Abramowitz earned a B.A. from Columbia University in 1972 and an M.B.A. from Harvard Business School in 1976. Mr. Abramowitz currently sits on the boards of the following privately held companies: OptiScan Biomedical Corporation (a company that develops continuous monitoring systems for use in hospital ICUs), Cerapedics, Inc. (an orthobiologics company), Entera Bio Ltd. (a biotechnology company) and MitralTech Ltd. (a company that develops and manufactures cardiovascular devices for mitral valve replacement). Mr. Abramowitz previously served as a director at EKOS Corp., Small Bone Innovations, Inc., Option Care, Inc., Sightline Technologies Ltd. (acquired by Stryker) and Power Medical Interventions (acquired by Covidien), as well as MedPointe and ConnectiCare Holdings, Inc.

Among other qualifications, Mr. Abramowitz brings to Akorn’s Board analytical expertise,in-depth research and valuable perspective of healthcare and biotechnology companies gained from his experience as aco-founder, managing general partner and his other leadership and analyst roles at international investment firms with specialization in healthcare, as well as his current and prior service on the boards of privately held healthcare, biotechnology and medical device companies.

ADRIENNE GRAVES, PH.D | ||

Director Since:2012 Age: 63 | Committees: • Compensation (chair), Nominating and Corporate Governance |

Dr. Graves was appointed a director by the Board in March 2012. Dr. Graves is a visual scientist by training and a global industry leader in ophthalmology. From 2002 to 2010, Dr. Graves was President and Chief Executive Officer of Santen Inc., the U.S. subsidiary of Santen Pharmaceutical Co., Ltd., Japan’s market leader in ophthalmic pharmaceuticals. Dr. Graves joined Santen Inc. in 1995 as Vice President of Clinical Affairs to initiate the company’s clinical development efforts in the U.S. Prior to joining Santen, Dr. Graves spent nine years with Alcon Laboratories, Inc. in various roles, including Senior Vice President, World Wide Clinical Development and Vice President Clinical Affairs. She currently serves on the boards of directors of the public companies TearLab Corporation (NASDAQ: TEAR) and Nicox SA (Euronext Paris; COX) and the privately held companies Aerpio Therapeutics, Envisia Therapeutics and Encore Vision. Dr. Graves is also a board member for severalnon-profit organizations, including the American Academy of Ophthalmology Foundation (Emeritus), the American Association for Cataract and Refractive Surgery, the Glaucoma Research Foundation, KeepYourSight Foundation, and Himalayan Cataract Project. Dr. Gravesco-founded Ophthalmic Women Leaders and Glaucoma 360. She received her B.A. in Psychology with honors from Brown University, her Ph. D. in Psychobiology from the University of Michigan and completed a postdoctoral fellowship in visual neuroscience at the University of Paris.

Among other qualifications, Dr. Graves brings to Akorn’s Board more than 30 years of ophthalmic pharmaceutical industry experience, business leadership skills, and a deep knowledge ofpre-clinical and clinical development in this sector, regulatory affairs and pharmaceutical sales and marketing, as well as a vast network of leading clinicians and thought leaders in the ophthalmic space and a familiarity with corporate governance matters gained in part from serving as CEO and head of R&D at Santen and serving on other public company boards.

| AKORN, INC. - 2017 Proxy Statement | 12 |

II. PROPOSALS |

RONALD JOHNSON | ||

Director Since: 2003 Age: 71 | Committees: • Audit, Compensation |

Mr. Johnson was appointed a director by the Board in May 2003. Mr. Johnson served as President of Becker & Associates Consulting, a firm which provides consulting services to the pharmaceutical, biologics and medical device industries on FDA regulatory requirements, from 2011 until retiring from that firm in 2013, and currently continues to serve as an independent consultant. Previously, Mr. Johnson served as Executive Vice President of The Lewin Group, a subsidiary of Quintiles Transnational, Inc., which provides various healthcare consulting services to state and federal governments, healthcare insurers and healthcare institutions. Prior to joining The Lewin Group, Mr. Johnson served as Executive Vice President of Quintiles Consulting, a business unit of Quintiles Transnational, Inc. Quintiles Consulting provides consulting services to the pharmaceutical, medical device, biologic and biotechnology industries in their efforts to meet FDA regulatory requirements. Mr. Johnson also spent 30 years with the FDA, holding various senior level positions primarily in the compliance and enforcement areas.

Among other qualifications, Mr. Johnson brings to Akorn’s Board extensive experience in managing regulatory and compliance requirements of the FDA, particularly in pharmaceutical, medical device, biologic and biotechnology industries, as well as a deep knowledge and understanding of FDA policies and procedures regarding cGMP compliance, quality control processes and outcomes reporting gained from his years of providing specialized consulting services to governments, pharmaceutical companies and healthcare institutions and working at the FDA.

STEVEN MEYER | ||

Director Since: 2009 Age: 60 | Committees: • Audit (chair), Nominating and Corporate Governance |

Mr. Meyer was appointed a director by the Board in June 2009. Since 2005, Mr. Meyer has served as the Chief Financial Officer of JVM Realty, a private investment firm specializing in the acquisition,re-positioning and management of real estate for investors. Prior to that, Mr. Meyer was employed by Baxter International Incorporated, a global healthcare company that provides renal and hospital products. Mr. Meyer served as the Corporate Treasurer and International Controller and VP of Global Operations during a23-year career at Baxter International, Inc. Mr. Meyer serves as the chairman of the board of directors and as chair of the audit committee of INSYS Therapeutics (NASDAQ: INSY), a publicly held drug development company focused on pain and oncology. Mr. Meyer earned his MBA in finance and accounting from the Kellogg Graduate School of Management at Northwestern University and his B.A. in Economics from the University of Illinois in Champaign-Urbana. He is an Illinois Certified Public Accountant.

Among other qualifications, Mr. Meyer brings to Akorn’s Board financial expertise, extensive knowledge of the healthcare industry, including an international perspective, as well as business leadership skills, which he gained in part from serving as CFO of an investment firm, as the corporate treasurer and international controller and vice president of global operations at a Fortune 500 healthcare company and his service on the board of a publicly held specialty pharmaceutical company.

| AKORN, INC. - 2017 Proxy Statement | 13 |

II. PROPOSALS |

TERRY ALLISON RAPPUHN | ||

Director Since: 2015 Age: 60 | Committees: • Audit, Nominating and Corporate Governance |

Ms. Rappuhn was appointed a director by the Board in April 2015. In February 2016, Ms. Rappuhn was elected to the board of directors of Span-America Medical Systems, Inc. (NASDAQ: SPAN), a manufacturer of beds and pressure management products for the medical market. From 2006 to 2010, she served on the board of AGA Medical Holdings, Inc. (previously a publicly held company that was acquired by St. Jude Medical), a medical device company, where she served as the audit committee chairperson. From 2003 to 2007, she served on the board of directors of Genesis HealthCare Corporation (previously a publicly held company that merged), an operator of skilled nursing and assisted living centers, where she served as the audit committee chairperson. From 1999 to April 2001, Ms. Rappuhn served as Senior Vice President and Chief Financial Officer of Quorum Health Group, Inc. (previously a publicly held company that was acquired by Triad Hospitals, Inc.), an owner and operator of acute care hospitals. From 1996 to 1999 and from 1993 to 1996, Ms. Rappuhn served as Quorum’s Vice President, Controller and Assistant Treasurer and as Vice President, Internal Audit, respectively. Ms. Rappuhn has 15 years of experience with Ernst & Young, LLP and is a Certified Public Accountant.

Among other qualifications, Ms. Rappuhn brings to Akorn’s Board expertise in the fields of finance and accounting in various segments of the healthcare industry, especially hospital operations, knowledge of information technology controls, including cybersecurity, and understanding of strategic, operational and financial issues of public companies, gained from serving as a board member and chief financial officer of rapidly expanding healthcare public companies that were building infrastructure, processes and teams.

BRIAN TAMBI | ||

Director Since: 2009 Age: 71 |

Mr. Tambi was appointed a director by the Board in June 2009. Mr. Tambi serves as a member of the board of directors of Insys Therapeutics (NASDAQ: INSY), a publicly held drug development company focused on pain and oncology. Since forming the company in 2006, Mr. Tambi has served as the Chairman of its board, President and Chief Executive Officer of Antrim Pharmaceuticals, LLC, a pharmaceutical company focused on developing, manufacturing and marketing combinations of leading single agent drugs and delivery systems. From November 1995 to July 2006, Mr. Tambi was the Chairman of the board of directors, President and Chief Executive Officer of Morton Grove Pharmaceuticals, Inc., a leading manufacturer and marketer of oral liquid and topical pharmaceuticals. Prior to Morton Grove, Mr. Tambi served as President of Ivax North American Pharmaceuticals and as a member of the board of directors of Ivax Corporation (previously a publicly held pharmaceutical company that was acquired by Teva). Mr. Tambi also served as Chief Operating Officer of Fujisawa USA, Inc., a subsidiary of Fujisawa Pharmaceutical Company, Ltd. Mr. Tambi also held executive positions at Lyphomed, Inc. and Bristol-Myers Squibb. Mr. Tambi earned his MBA in International Finance & Economics and his B.S. in Corporate Finance from Syracuse University. Under our April 13, 2009 Modification, Warrant and Investor Rights Agreement with EJ Funds, EJ Funds has the right to require us to nominate two directors to seats on our Board. Mr. Tambi was designated by EJ Funds for one of the seats (the other seat remains vacant).

Among other qualifications, Mr. Tambi brings to Akorn’s Board extensive pharmaceutical industry experience, particularly FDA knowledge and drug development and commercialization expertise, as well as business leadership skills gained from his experience as a founder, executive and board member of numerous public and private pharmaceutical companies.

| AKORN, INC. - 2017 Proxy Statement | 14 |

II. PROPOSALS |

ALAN WEINSTEIN | ||

Director Since: 2009 Age: 74 | Committees: • Compensation, Nominating and Corporate Governance (chair) |

Mr. Weinstein was appointed a director by the Board in July 2009. Since 2000, Mr. Weinstein has provided consulting services to supplier clients in the areas of hospital organization, hospital operations, and working with GPOs. Mr. Weinstein founded and served as President of Premier, Inc., a national GPO providing services for hospitals nationwide. Mr. Weinstein serves as a director on the board of OpenMarkets, which provides a services and technology platform for efficiently purchasing healthcare equipment, and on the board of trustees of the Rosalind Franklin University of Medicine and Science. Previously, Mr. Weinstein served on the boards of privately held companies in the healthcare industry whose primary customers were hospitals, including: Vascular Pathways, Inc. (a medical device company), Precyse (a healthcare services and technology company), SutureExpress (a healthcare services company) and Sterilmed, Inc. (a healthcare services company).

Among other qualifications, Mr. Weinstein brings to Akorn’s Boardin-depth knowledge of the provider side of the healthcare industry, specifically hospital management, materials management and channel partner relationships, as well as business leadership and innovative and strategic planning skills gained from his years of service as a founder, and later a consultant, advisor and board member, for a number of privately held healthcare services/technology companies.

Required Disclosure

None of our directors or executive officers has a family relationship that is required to be disclosed under Item 401(d) of RegulationS-K of the Exchange Act. During the past ten years none of the persons currently serving as an executive officer and/or director of the Company has been the subject matter of any legal proceedings that are required to be disclosed pursuant to Item 401(f) of RegulationS-K, which include: (a) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (b) any criminal convictions or a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses); (c) any order, judgment, or decree permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; (d) any finding by a court, the SEC or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, any law or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or (e) any sanction or order of any self-regulatory organization or registered

entity or equivalent exchange, association or entity. Further, no such legal proceedings are believed to be contemplated by governmental authorities against any director or executive officer.

The Company’s Board of Directors consists of nine seats, one of which is vacant and is expected to remain vacant beyond the date of the Company’s 2017 annual meeting. The vacant seat is reserved for a nominee to be named by EJ Funds, LP, a company controlled by our Chairman, in accordance with terms of a Modification, Warrant and Investor Rights Agreement entered into on April 13, 2009. Proxies cannot be voted for a greater number of persons than the number of nominees.

Information Regarding Our Audit Committee

During fiscal year 2016, with the oversight and guidance of the Audit Committee, the Company successfully remediated all aspects of the material weaknesses identified in the Company’s Form 10-K for the year ended December 31, 2015. This was a major accomplishment which has significantly strengthened the Company’s internal controls over financial reporting. Under the current members of the Audit Committee, the

| AKORN, INC. - 2017 Proxy Statement | 15 |

II. PROPOSALS |

Company implemented actions to improve its internal control over financial reporting and disclosure controls and procedures including hiring financial leadership and personnel for the finance organization with appropriate experience and certification. Also, the Company supplemented and enhanced resources and training for the organization. In addition, the Company effected proper tone at the top through these personnel changes and changes in policies. The Company established a SOX compliance function and a dedicated revenue accounting team. The personnel in these new functions established a structure that allows the Company to validate the completeness and accuracy of the underlying data used in the determination of significant estimates and accounting transactions. Also, management completed a financial close improvement project, redesigned processes, implemented more robust accounting policies, enhanced communications between accounting and tax, and introduced new management review controls. As a result, the Company has improved the timeliness and the level of precision of its control activities.

In addition, under the current Audit Committee, the Company has strengthened its risk assessment process by establishing mechanisms to identify, evaluate and monitor risks to financial reporting. Further, the Company has updated its global risk assessment process, evaluation, and mitigation strategies, and strengthened its internal audit plan to include internal audit monitoring of these activities. The Company has also implemented new procedures and enhanced controls governing its internalmanagement-led Disclosure Committee,sub-certification and external reporting processes associated with the review and approval of the content of its SEC filings and other public disclosures. Further, the Company has implemented controls to prevent or detect material errors in the financial statements of acquired subsidiaries. These controls consist of a comprehensive merger and acquisition integration approach, timely assessment of the target’s control environment, and a process to facilitate improvements in the subsidiary’s control

environment within the year of acquisition. The controls are specifically designed to evaluate the acquired subsidiaries’ application of accounting policies and procedures and identify material errors within subsidiary financial statements.

Although each of the prior year material weaknesses have been fully remediated, during the course of the Company’s 2016year-end close, the Company identified a material weakness in the internal controls surrounding the process in which the Company evaluates intangible asset impairment. It is important to note that this control deficiency did not result in a material misstatement to the Company’s consolidated financial statements for the year ended December 31, 2016, however given the significance and size of intangible assets on the Company’s balance sheet, the existing control over the accounting for IPR&D (in process research & development) indefinite-lived intangible assets required attention. With oversight from the Audit Committee, the Company’s management has begun to design and implement remediation measures, including designing, documenting, and implementing additional control procedures related to the review of the assumptions and data inputs used in the impairment assessment. The Company expects to fully complete its remediation plan before the end of 2017.

Vote Required

If elected at the 2017 annual meeting, each of the nominees would serve until the 2018 annual meeting and until his or her successor is elected and has qualified, or, if earlier, until the director’s death, resignation or removal. Directors are elected by a plurality of the votes properly cast in person or by proxy. The eight nominees receiving the highest number of affirmative votes will be elected. In the unanticipated event that one or more of such nominees becomes unavailable as a candidate for director, the persons named in the accompanying proxy will vote for another candidate nominated by the Board. Each person nominated for election has agreed to serve if elected. We have no reason to believe that any nominee will be unable to serve.

��

| ✓ | The Board of Directors recommends a vote “FOR ALL” of the named nominees in Proposal 1. |

| AKORN, INC. - 2017 Proxy Statement | 16 |

II. PROPOSALS |

| PROPOSAL 2 | RATIFICATION OF THE APPOINTMENT OF BDO USA, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2017 |

The Board is seeking shareholder ratification of the Audit Committee’s selection of BDO USA, LLP (“BDO”) to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2017. The Audit Committee initially engaged BDO on January 14, 2016 to perform independent audit services. BDO has served as our independent registered public accounting firm for the years ended December 31, 2013, 2014, 2015 and 2016.

We expect representatives of BDO will be in attendance at the 2017 annual meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions from shareholders regarding their engagement.

Although the Company is not required to submit the selection of independent registered public accountants for shareholder approval, if the shareholders do not ratify this selection, the Board may reconsider the selection of BDO. The Board considers BDO to be well qualified to serve as the independent auditors for the Company, and fully intends to retain BDO’s services throughout 2017. However, even if the selection is ratified, our Board reserves the right to direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee and Board determine that the change would be in our best interests.

During our fiscal year ended December 31, 2016, neither we, nor anyone on our behalf, consulted

BDO regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered with respect to our consolidated financial statements, and no written report or oral advice was provided us by BDO that BDO concluded was an important factor considered by us in reaching a decision as to any accounting, auditing or financial reporting issue; or (ii) any matter that was the subject of a “disagreement” or a “reportable event”.

Independent Registered Public Accounting Firm Fees

In 2016, the Company engaged BDO as its independent registered public accounting firm to audit its annual consolidated financial statements for fiscal year 2016, as included in the Company’s Annual Report on Form10-K, review interim condensed consolidated financial statements and audit the Company’s internal controls over financial reporting. The following table and footnotes present fees for professional audit services of BDO for the audit of Akorn’s annual financial statements for the year ended December 31, 2016. However, it is not possible to break out the Audit Fees related to 2015 and therefore the following table and footnotes present fees for professional audit services of BDO for the audit of Akorn’s annual financial statements for the years ended December 31, 2013, 2014 and 2015. The table sets for fees billed for other services rendered by BDO during 2015 and 2016:

| 2016 | 2015 | |||||||

Audit Fees | $ | 2,506,510 | $ | (1) | ||||

Audit-Related Fees | — | — | ||||||

Tax Fees | — | 26,428 | (2) | |||||

All Other Fees | — | 94,416 | (3) | |||||

TOTAL | $ | 2,506,510 | $ | (1) | ||||

| AKORN, INC. - 2017 Proxy Statement | 17 |

II. PROPOSALS |

| (1) | BDO’s Audit Fees totaled $6.4 million for its services to audit the Company’s annual consolidated financial statements for fiscal years 2015, 2014 and 2013, review interim condensed consolidated financial statements and audit our internal controls over financial reporting. It is not possible to break out the Audit Fees related to each of 2015, 2014 and 2013, and therefore the amounts represent fees for auditing all three years. |

| (2) | The amount shown represents fees billed for tax services rendered in connection with the acquisition of VersaPharm. |

| (3) | The amount shown represents fees billed for consulting services provided to Akorn India Private Limited, a wholly owned subsidiary of the Company, including training and related services. |

Audit CommitteePre-Approval Policies and Procedures

The Audit Committee has considered whether the provision of services covered in the preceding paragraphs is compatible with maintaining independence of our registered public accounting firm. At their regularly

scheduled and special meetings, the Audit Committee considers andpre-approves any audit andnon-audit services to be performed for us by our independent registered public accounting firm. In 2016, there were no audit services, audit-related services or tax services that were performed by BDO.

| ✓ | The Board of Directors unanimously recommends that you vote “FOR” the ratification of BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2017. |

| AKORN, INC. - 2017 Proxy Statement | 18 |

II. PROPOSALS |

| PROPOSAL 3 | APPROVAL OF THE AKORN, INC. |

On October 26, 2016, ourIn February 2017, the Board adopted, subject to shareholder approval,of Directors (the “Board”) approved the adoption of the Akorn, Inc. 2016 Employee Stock Purchase2017 Omnibus Incentive Compensation Plan (the “2016 ESPP”“Plan”)., subject to approval by our shareholders. The 2016 ESPPBoard adopted the Plan as a flexible omnibus incentive compensation plan that would allow the Company to use different forms of compensation awards to attract new employees, executives and directors, to further the goal of retaining and motivating existing personnel and directors and to further align such individuals’ interests with those of our shareholders. Accordingly, the Board is intendedseeking shareholder approval of the Plan.

The following information regarding the Plan is being provided to replace the Amended and Restated Akorn, Inc. Employee Stock Purchase Plan (the “Prior ESPP”), which was terminated in 2015you in connection with our restatement process. The purposesthe solicitation of proxies for the approval of the 2016 ESPP are to provide eligible employees with a convenient means of acquiring an equity interest in the Company through payroll deductions with no brokerage fees at a discounted rate, and to provide an incentive for continued employment. Under the 2016 ESPP, during a six-month or one-year offering period, eligible employees will be able to acquire shares of our common stock at a 15% discount from the loweradoption of the market price on the date the offering period begins or on the purchase date, contributing funds through payroll deductions not exceeding 15% of base wages.

If the 2016 ESPP is approved, 2,000,000 shares of common stock will be available for issuance thereunder, which represents approximately 1.6% of our shares of common stock outstanding on October 28, 2016.Plan. The 2016 ESPP is intended to qualify as an “employee stock purchase plan” within the meaning of Section 423 of the Internal Revenue Code of 1986, as amended (the “Code”).

The following is a brief description of the 2016 ESPP. ThisPlan is a summary only and does not purport to be complete. The summary is qualified in its entirety by reference to the fullPlan. The text of the 2016 ESPP, a copy of whichPlan is attached asAppendix A. to this proxy statement. You are urged to read the actual text of the 2016 ESPP in its entirety.Plan.

If approved by our shareholders, the 2016 ESPP will allow eligible employees to acquire shares of our common stock at a 15% discount. The 2016 ESPP will be effective upon approval by our shareholders, and will continue until terminated by the Board or all shares authorized to be purchased under the 2016 ESPP have been purchased.

Authorized Shares, Administration and Offering Period

If approved, the total amount of shares of our common stock acquired by participants in the 2016 ESPP will not exceed 2,000,000 shares. In the event of any recapitalization, stock dividend, stock split, combination of shares or other change in our common stock, the number of shares of common stock permitted to be purchased under the 2016 ESPP will be adjusted in proportion to the change in outstanding shares of common stock. This 2016 ESPP will be administered under the direction of the Board or a committee designated by the Board in accordance with applicable laws and regulations (the “Committee”). The Company will pay all expenses incurred in connection with the administration of the plan.

There will be two offering periods (the “Offering Periods”) each calendar year during the 2016 Plan: (i) the period from January 1 through December 31; and (ii) the period from July 1 through December 31, provided, however, for the initial year of the plan only, 2017, the first Offering Period will begin January 9 and run through December 31. The Committee may also designate other offering periods from time to time. A participant may participate in only one Offering Period at a time.

Eligible Participants and Payroll Deductions

Employees eligible to participate in the 2016 ESPP are those employed by the Company or a designated subsidiary on the day before the first day of the Offering Period, and customarily employed for more than 20 hours per week and 5 months in a calendar year. However, no employee will be eligible to participate in the 2016 ESPP who owns stock or holds options to purchase stock possessing 5% or more of the total combined voting power or value of all classes of stock of the Company or a subsidiary, or as a result of being granted an option under the 2016 ESPP with respect to such Offering Period, would own stock or hold options to purchase stock possessing 5% or more of the total combined voting power or value of all classes of stock of the Company or any subsidiary. As of October 26, 2016, approximately 1,600 permanent employees, including seven executive officers, would be eligible to participate in the 2016 ESPP.

To participate in the 2016 ESPP, an eligible employee must authorize payroll deductions from his or her current compensation in whole percentages from 1% to 15%, or such lower limit as may be set by the Company from time to time.

Purchase of Shares

At the end of each Offering Period, the Company will automatically apply the funds then in the participant’s payroll deduction account to purchase the applicable number of whole shares of common stock. The purchase price of such shares will be the lower of (i) 85% of the fair market value of a share of common stock on the first day of the Offering Period or (ii) 85% of the fair market value of a share of common stock on the date of purchase, which would be the last trading day of the Offering Period.

As promptly as practicable after the end of each Offering Period, the Company will electronically issue shares of common stock purchased for a participant into the participant’s brokerage account. No fractional shares will be issued to a participant. Any cash remaining in a participant’s payroll deduction account following the purchase of such shares of our common stock will be returned to the participant as soon as administratively feasible without interest. A participant will have no interest in any shares of common stock, including any voting rights, until the Company has purchased shares of common stock for such participant.

Limitations on Purchase and Transfer of Shares

No participant will be entitled to purchase shares of common stock under the 2016 ESPP with a fair market value that exceeds $25,000, as determined as of the first day of the Offering Period, in any calendar year in which such participant participates in the 2016 ESPP (or such other limit as may be imposed by the Code). The Company will automatically suspend the payroll deductions of any participant as necessary to enforce this limit. Except as otherwise determined by the Company prior to the first day of an Offering Period, the aggregate number of shares that may be purchased by an individual participant in an Offering Period will not exceed 15,000 shares.

If the number of shares of common stock to be purchased by all participants for an Offering Period exceeds the number of shares then available for issuance under the 2016 ESPP, then the Company will make apro rata allocation of the remaining shares of common stock in as uniform manner as will be reasonably practicable and equitable. In such event, the Company will give written notice of such reduction of the number of shares of our common stock to be purchased to each participant affected.